Historical Simulation

Historical Simulation is the Most Accurate Simulation Technique Available

Most accurate simulation?

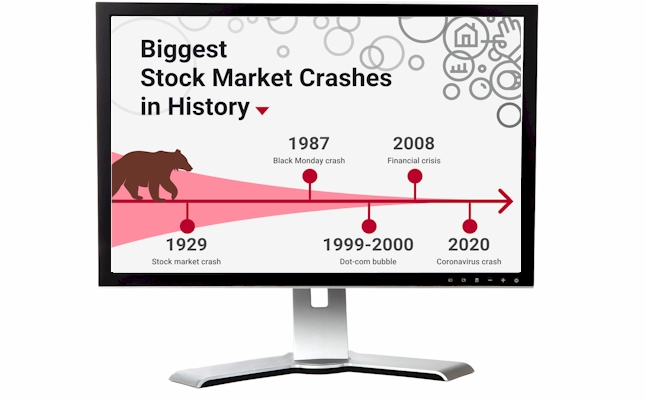

Think about it for a second. The historical simulation takes you through the booms and busts of the stock market. If we simulation your retirement in 1928, you get the roaring twenties as well as the great depression. Simulate your retirement starting in the 1970’s, you get skyrocket inflation but also a growing economy. In other words, this simulation gives you real life results.

Traditional Simulation

Traditional Simulations include Linear and Random SimulationsLinear Simulations

The linear simulator takes the basic information and simulates each year of retirement. By using a linear calculation for the income and expenses based on the information you provided we can see if you will run out of money. For example, you could say Cash will return 0.5%, Bonds will return 2.0% and Stocks will return 5%. The linear simulation just applies these each year to see where ending balance will be. However, are these numbers too low? Clearly, way below average.

The linear market is the easiest to calculate and perhaps the most popular among online simulations. Unfortunately, the linear simulation is simplistic and doesn’t reflect the complexity of the markets.

Random Simulations (Monte-Carlo)

Monte Carlo simulation performs risk analysis by building models of possible results by substituting a range of values, called a probability distribution, for any of the rates of return and inflation. By running this simulation 10,000 times, we should be able to see the probability of running out of money during retirement.

The benefit of using a Monte Carlo simulation is that you bring in the possibility of a series of bad returns. The model using randomness based on averages and average distribution which is then run over 10,000 times. The concern with Monte Carlo is that the results seem to be overstated. Like the historical average model, we have to think about lower returns in the future.

Historical Simulation Overview

Example of Calculating the Historical SimulationThe simplest way to explain the historical simulation is to walk through an example. Let’s assume we want to simulate a 10-year period. We have data from 1928 up through 2021 which means we have around 94 different 10-year time periods. The first would be 1928 through 1937, the second would be 1929 through 1938, and so on. The time slices would pick up all the Black Swan events of the past 100 years including the great depression, world wars, oil shocks, real estate bubbles, etc. The following table shows you the historical rates of return for 1928-1937.

| Year | Cash % | Bonds % | Stocks % | Inflation % |

|---|---|---|---|---|

| 1928 | 3.08% | 0.84% | 43.81% | -1.14% |

| 1929 | 3.16% | 4.2% | -8.3% | 0% |

| 1930 | 4.55% | 4.54% | -25.12% | -2.66% |

| 1931 | 2.31% | -2.56% | -43.84% | -8.94% |

| 1932 | 1.07% | 8.78% | -8.64% | -10.3% |

| 1933 | 0.96% | 1.86% | 49.98% | -5.09% |

| 1934 | 0.32% | 7.96% | -1.19% | 3.51% |

| 1935 | 0.18% | 4.47% | 46.74% | 2.56% |

| 1936 | 0.17% | 5.01% | 31.94% | 1.04% |

| 1937 | 0.3% | 1.38% | -35.34% | 3.73% |